difference between islamic capital market and conventional capital market

Evidences suggest Islamic banking is very much practiced like. In place of interest a profit rate is.

Pdf Islamic Capital Markets Developments And Issues

The book explains each topic from both the conventional and the Islamic perspective offering a full understanding of Islamic.

. A conventional market allows and in fact invites investors to. Any loan given by Islamic Banks must be interest free. A Comparative Approach 2nd Edition looks at the similarities and differences between Islamic capital markets and conventional capital markets.

In Conventional Banks almost all the financing and deposit side products are loan based. Negatives of the Capitalist Economic System. In Pakistan Islamic banking is at infant stage although last 10 years growth is marvelous.

Islamic finance is a form of business and corporate financing designed on. The use of proceeds can be defined as how the company generates income from the received funds in the capital market for deploying the capital market. Due to both impossibility of comparison of u li es and fixed-wage payment to labor.

Conventional money market instrument most of instrument used debt contract where the one who borrow need to pay for the interest rate or fixed interest rate such repurchased agreement. If there are some restrictions they are imposed by human beings and are always subject to change. Differences in Islamic and conventional banking.

Yet the basic difference between capitalist and Islamic economy is that in secular capitalism the profit motive or private ownership are given unbridled power to make economic decisions. It is governed and regulated by man-laid principles. The loan contract for Conventional Financing is known as a Loan Facility Agreement.

Money is a product besides medium of exchange and store of value. The primary assumption in utility theory. Islamic Banks recognize loan as non-commercial and exclude it from the domain of commercial transactions.

The key features differentiating between Islamic finance and conventional finance are summarized in the following table. Given the obvious pitfall in conventional finance where the productivity of capital is fixed irrespective of the outcome of investment as well as the incidents where the finance providers take the largest chunk of the returns Islamic Finance provides the best way out. Key Differences between Conventional and Islamic Banking.

Islamic Financing Principles Islamic Financing avoids interest-based transactions riba and instead introduces the concept of buying something on the borrowers behalf and selling it back to the borrower at profit. Islamic economy is the ethical alternative to speculative Capitalism. Emphasis on self-interest to the neglect of other aspects of the complexities of human nature.

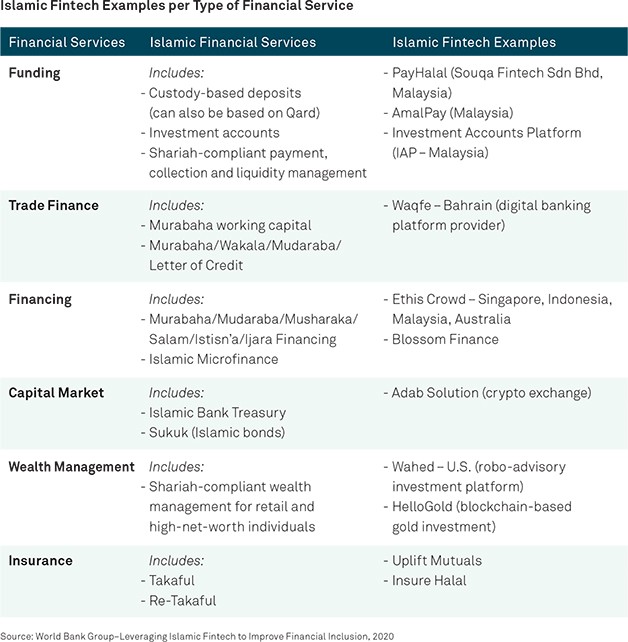

The book explains each particular topic from both the conventional and the Islamic perspective offering a full understanding. A comprehensive examination of Islamic capital markets. Islamic capital market as a part of Islamic economic system serves to increase efficiency in the management of resources and capital as well as to support investment activities The products and activities of capital markets should reflect the principles of Islam based on the principles of trust and the presence of real assets or activities as an underlying object.

Islamic capital market products exist mainly in six main places. Hearing and concluded. Now let us review some major differences between Islamic banking and conventional banking systems.

Taking a comparative approach to the subject this text looks at the similarities and differences between Islamic capital markets and conventional capital markets. Real Asset is a product. The main difference between conventional finance and Islamic finance is that some of the practices and principles that are used in conventional finance are strictly prohibited under Sharia laws.

Reward of three is fixed and all risk is born by the entrepreneur alone. Raising capital is equally important to both the conventional market and the Islamic Capital Market except that there is a major difference in the nature of investments and investors choices. Yet the basic difference between capitalist and Islamic economy is that in secular conventional capitalism the profit motive or private ownership are given unbridled power to make economic decisions.

The Conventional capital market main customers are profit seekers who are either providers of funds or demanders of funds. Money is just a medium of exchange. Nowadays the Islamic finance sector grows at 15-25 per year while Islamic financial institutions oversee over 2 trillion.

The difference between the conventional and Islamic market of capital market is how the procedure runs either according to the standards rather than the prescribed ones. According to Saad et al 2013 integrating Waqf with Islamic micro-finance could assist in reducing the cost of capital in operations of Islamic micro-finance and ensure utilisation of the. Issuance process is the process where the both.

Conventional Bank treats money as a commodity and lend it against interest as its compensation. The theoretical differences between Islamic and conventional banks do not have clear implications for total earnings the capability to access market capital or efficiency. Places The Islamic capital market is traded in the same places as the conventional ones since no Islamic-only exchanges exist.

Second differences between the Islamic money market instrument and conventional money market instrument is issuance process. Their liberty is not controlled by any divine injunctions. The principles and rules of shariah are the basis for all modes of finance and investment.

Money is a medium of exchange and store of value but not a commodity. The liberty which Islam guarantees is not controlled by any divine. Higher complexity in combination with the relatively young age of the Islamic financial institutions is likely to result in higher costs and thus a lower level of cost.

In capitalism capital is a factor of production and hence deserves the fixed reward in the form of interest --- a risk free reward. Islamic banking has grown at an average annual rate of 63 in the last ten years 0104 -.

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Sweet Sukuk The Association Of Corporate Treasurers

Difference Between Islamic Capital Market And Conventional Capital Market Difference Between Islamic Economic System And Capitalism Goods Services Money Basic Difference Between Islamic And Conventional Modes Of Finance

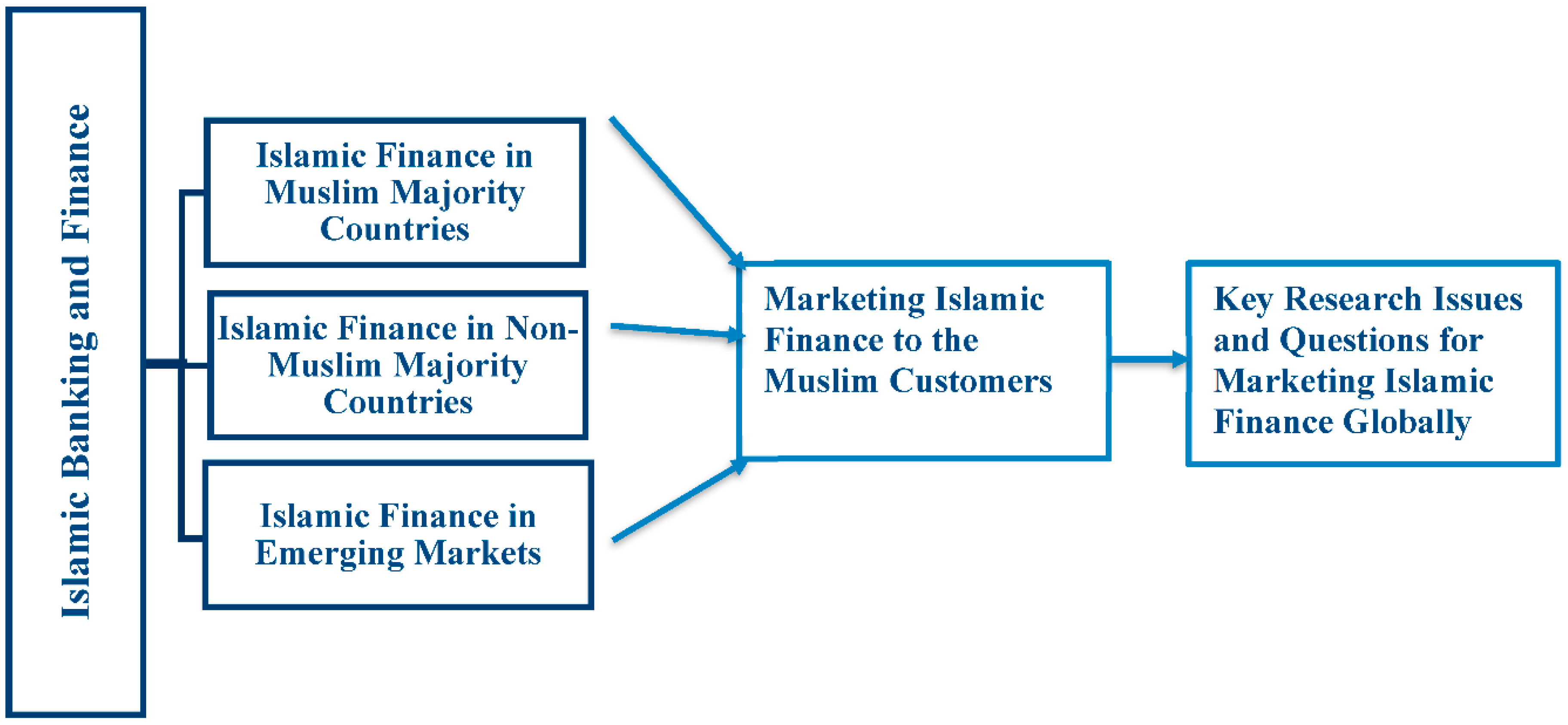

Jrfm Free Full Text Marketing Islamic Financial Services A Review Critique And Agenda For Future Research Html

Overview Of Different Types Of Conventional And Islamic Banks Download Scientific Diagram

Islamic Capital Market Overview Role Of Sukuk Islamic Finance A Paradigm Shift In Africa 28th 29th March 2011 Crowne Plaza Hotel Nairobi Kenya Ijlal Ppt Download

Islamic Capital Markets Ppt Download

Pdf Compare And Contrast Sukuk Islamic Bonds With Conventional Bonds Are They Compatible Semantic Scholar

Islamic Capital Market Overview Role Of Sukuk Islamic Finance A Paradigm Shift In Africa 28th 29th March 2011 Crowne Plaza Hotel Nairobi Kenya Ijlal Ppt Download

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Difference Between Islamic Capital Market And Conventional Capital Market Difference Between Islamic Economic System And Capitalism Goods Services Money Basic Difference Between Islamic And Conventional Modes Of Finance

A Comparison Between Malaysia And Indonesia In Islamic Banking Industry Semantic Scholar

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Islamic Accounting Practices The Importance Of Islamic Capital Mark

The Growing Global Appeal Of Islamic Finance

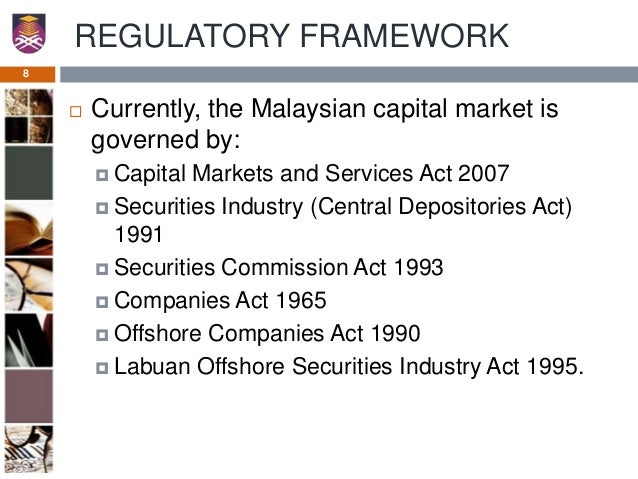

Overall Structure And Regulatory Framework Of Islamic Capital Market Ppt Download